Apple today

announced financial results for its third fiscal quarter of 2025, which corresponds to the second calendar quarter of the year.

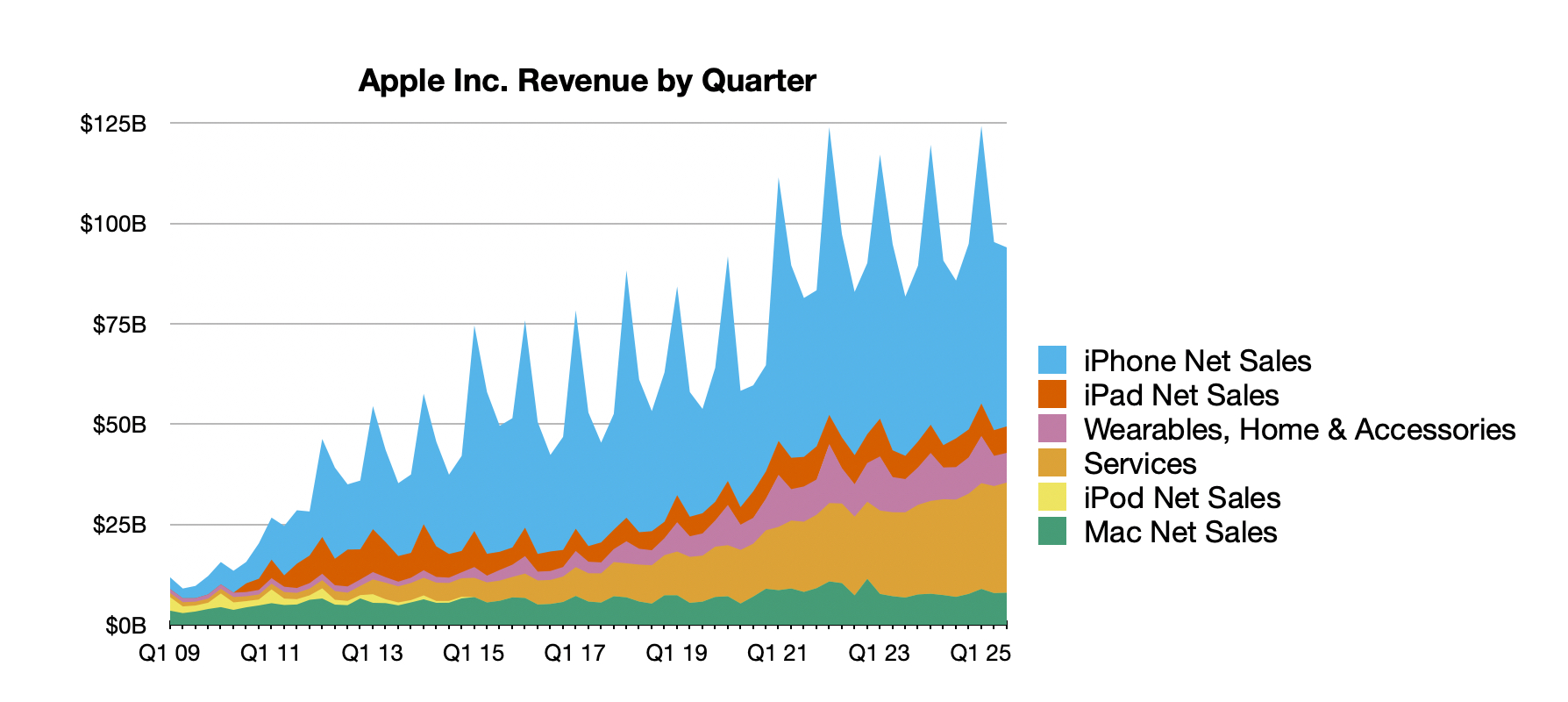

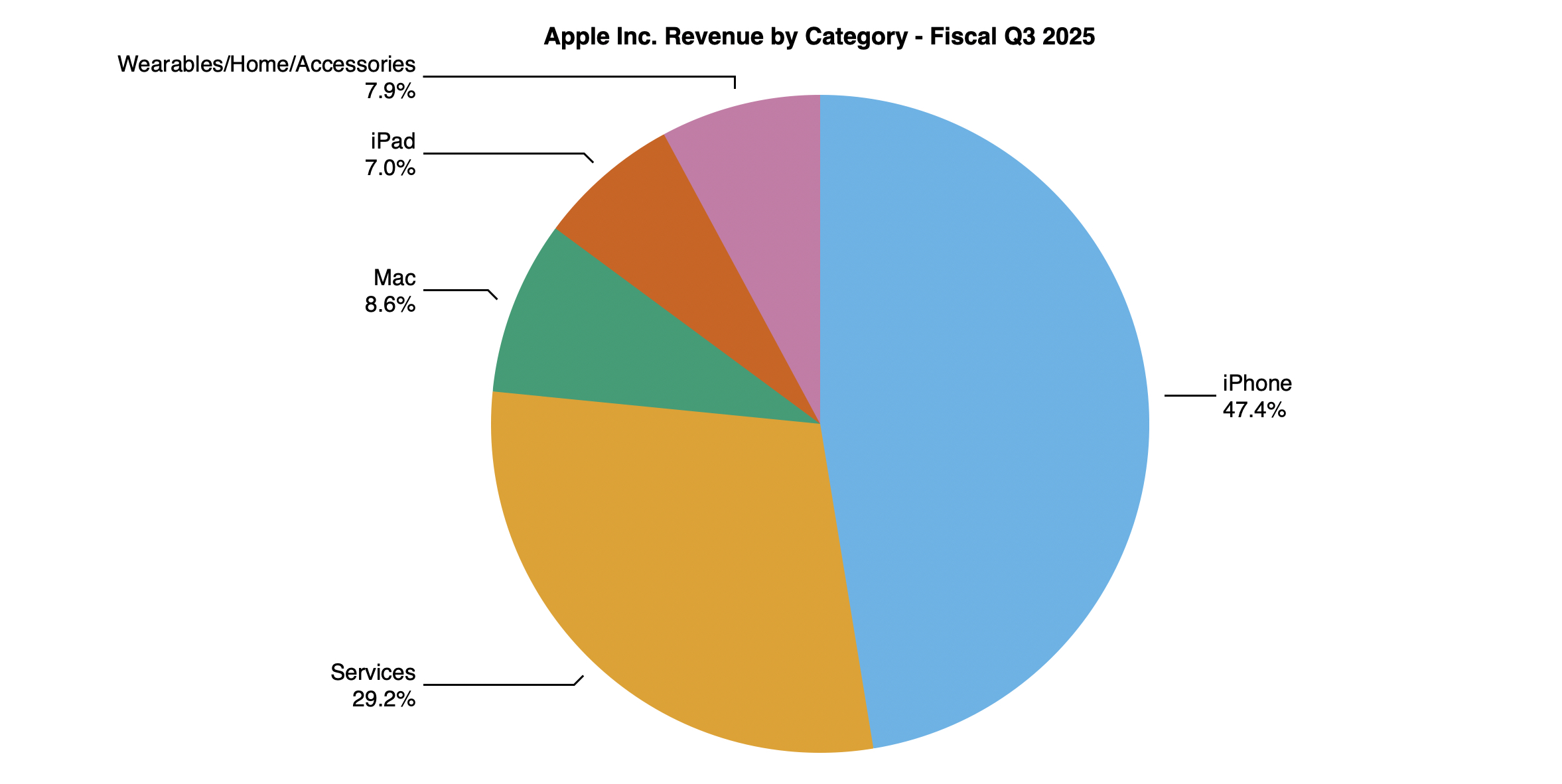

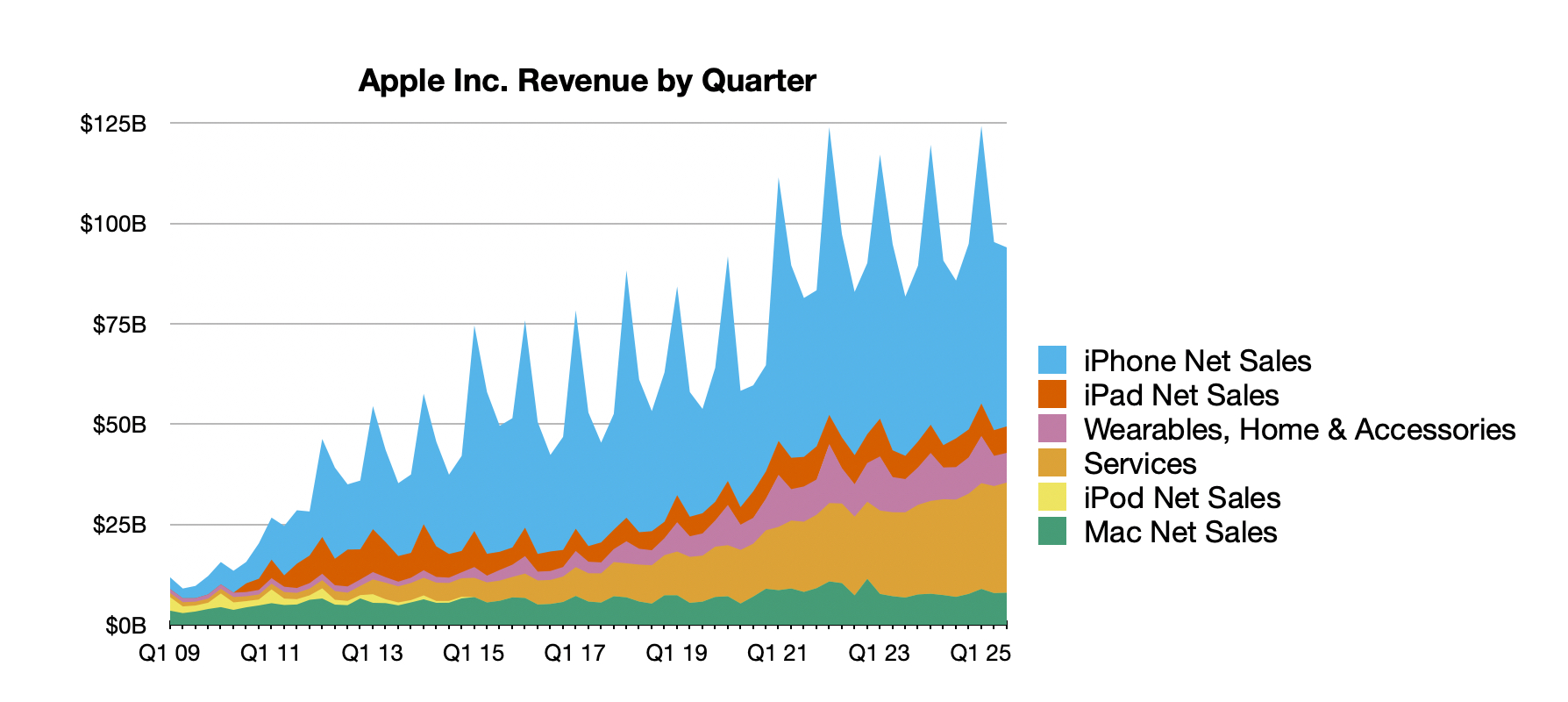

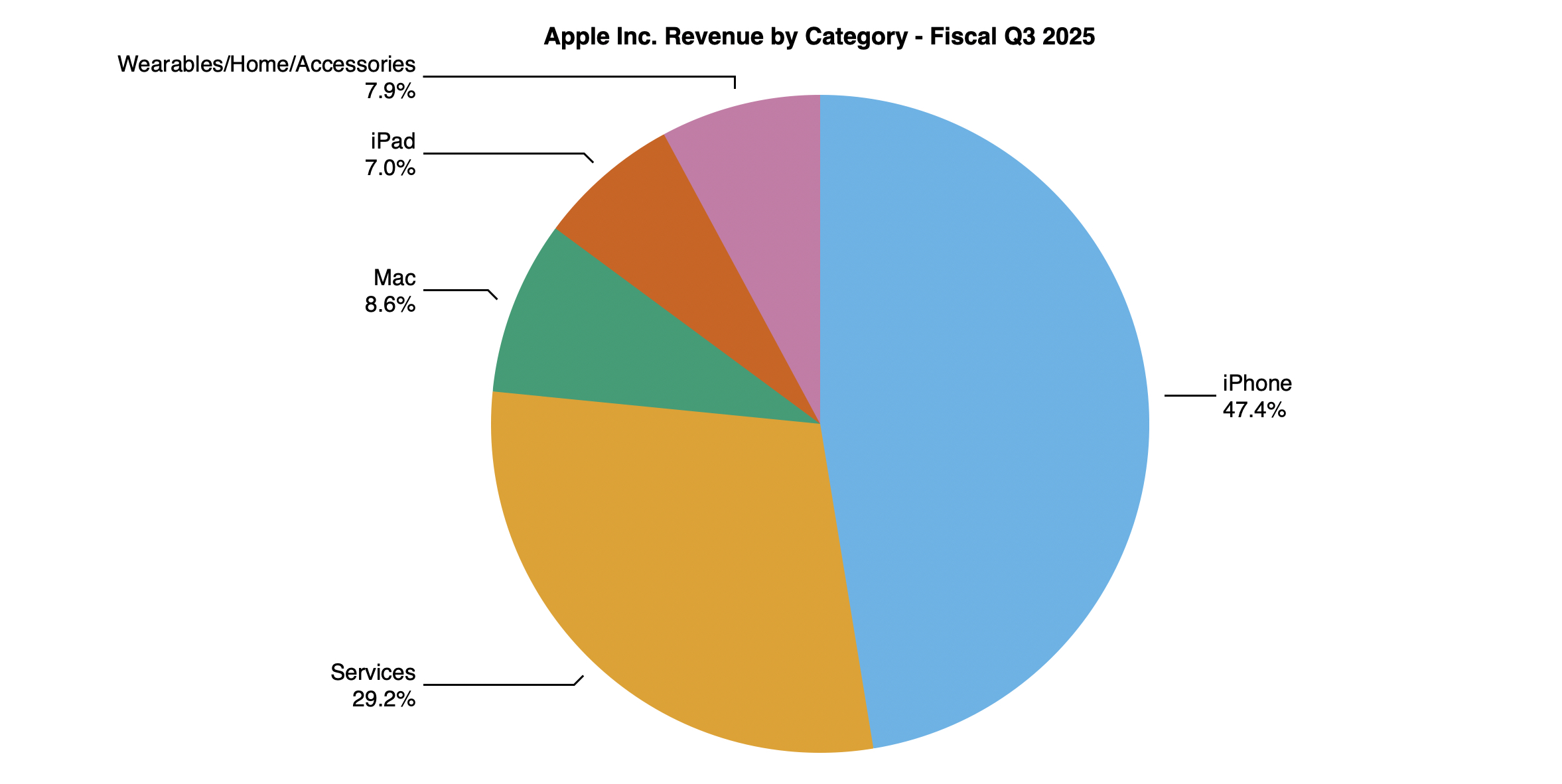

For the quarter, Apple posted revenue of $94.0 billion and net quarterly profit of $23.4 billion, or $1.57 per diluted share, compared to revenue of $85.8 billion and net quarterly profit of $21.4 billion, or $1.40 per diluted share, in the

year-ago quarter.

Apple set new June quarter records for total revenue, as well as

iPhone revenue and earnings per share. The company also set an all-time record for Services revenue.

Gross margin for the quarter was 46.5 percent, compared to 46.3 percent in the year-ago quarter. Apple also declared a quarterly dividend payment of $0.26 per share, payable on August 14 to shareholders of record as of August 11.

"Today Apple is proud to report a June quarter revenue record with double-digit growth in iPhone, Mac and Services and growth around the world, in every geographic segment," said Tim Cook, Apple's CEO. "At WWDC25, we were excited to introduce a beautiful new software design that extends across all of our platforms, and we announced even more great Apple Intelligence features."

As has been the case for over five years now, Apple is once again not issuing guidance for the current quarter ending in September.

Apple will

provide live streaming of its fiscal Q3 2025 financial results conference call at 2:00 p.m. Pacific, and

MacRumors will update this story with coverage of the conference call highlights.

Conference call recap ahead...

1:40 pm: Apple saw strong year-over-year growth in iPhone (13.5%), Mac (14.8%), and Services (13.3%) revenue, while

iPad (–8.1%) and Wearables/Home (–8.6%) saw modest declines.

1:41 pm: Apple's share price is up 2% in after-hours trading following the earnings release. Shares were down 0.7% in regular trading today.

1:42 pm: "We are very pleased with our record business performance for the June quarter, which generated EPS growth of 12 percent," said Kevan Parekh, Apple's CFO. "Our installed base of active devices also reached a new all-time high across all product categories and geographic segments, thanks to our very high levels of customer satisfaction and loyalty."

1:56 pm: Apple's quarterly earnings conference call should begin in approximately five minutes. It will likely feature Apple CEO

Tim Cook and CFO Kevan Parekh giving statements and taking questions from financial analysts.

1:59 pm: After closing at $207.57, AAPL spiked nearly as high as $214 before giving back some and is now hovering around $210.

2:01 pm: The call is beginning, with warnings about forward-looking statements from Suhasini Chandramouli, Apple's head of investor relations.

2:03 pm: Tim Cook is on, saying the record June quarter was "better than we expected" with sales growth up 10% and earnings per share up 12% year over year. "We had June quarter revenue records in more than two dozen countries and regions." There were June quarter records of iPhone sales, up 13% year over year, and double digit growth in emerging markets including Middle East, South Asia and Brazil. Mac sales were up 15%, and record Services revenue up 13%.

2:04 pm: Now he's reminding everyone about the introductions at WWDC, including the UI redesign with Liquid Glass. "We can't wait for users everywhere to experience it this fall."

2:05 pm: He's also reminding about new capabilities coming to

Apple Intelligence, including Live Translation and Workout Buddy, as well as support for new languages.

iOS 26, MacOS 26 and

iPadOS 26 are "by far the most popular developer betas we've had."

2:05 pm: "We see AI as one of the most profound technologies of our lifetime. We are embedding it across our devices and platforms, and across the country. We are also significantly growing our investments."

2:05 pm: "We're integrating AI features across our platforms in a way that is deeply personal, private and seamless, right where users need them."

2:06 pm: "We're making good progress on a more personalized

Siri, and as we've said before, we expect to release these features next year."

2:06 pm: "Apple silicon is at the heart of all of these experiences, enabling powerful Apple intelligence features to run directly on device. For more advanced tasks. our servers, also powered by Apple silicon, deliver even greater capabilities while preserving user privacy, through our private cloud compute architecture."

2:06 pm: "We're excited about the work we're doing in this space, and it's incredibly rewarding to see the strong momentum building."

2:07 pm: iPhone revenue was $44.6 billion, up 13% from a year ago, a June quarter record for upgraders. "This strong, broad-based performance was driven by the incredible popularity of the

iPhone 16 family, up strong double-digits year over year as compared to the 15 family."

Apple also shipped the 3 billionth iPhone since it launched in 2007.

2:08 pm: In Mac, revenue was $8 billion, up 15% year over year, driven by the strength of the new M4

MacBook Air. There was a June quarter record for upgraders, and great performance in emerging markets. The MacBook Air is the world's most popular laptop.

2:09 pm: "Mac users across our entire lineup are going to find delightful new ways to stay connected and productive" in

macOS Tahoe 26.

2:10 pm: iPad revenue was $6.6 billion, with the lineup "bringing together power and portability like never before." iPadOS 26 will be the biggest iPad software update ever.

2:11 pm: Wearables, Home and Accessories revenue was $7.4 billion with a June quarter record for upgraders to Apple Watch. The 10-year anniversary of Apple Watch is here, with updates coming to the Workout App and Smart Stack, as well as a "fresh, new design." Updates are coming to

Apple Vision Pro with VisionOS 26, too. Features for the AirPods lineup "will unlock even more possibilities" including using AirPods as a camera remote.

2:12 pm: "Since we first launched our hearing healthy features with

AirPods Pro 2, I've received notes from people who are delighted to be able to connect mroe deeply with loved ones."

2:12 pm: Services revenue for June was $27.4 billion, up 13% year over year and an all-time record. AppleTV got 81 nominations for the Emmy Awards.

2:13 pm:

Apple TV+ has earned more than 2,700 award nominations and 585 wins "on the strength of the highest-rated original content of any streaming network." TV+ viewership is up strong double-digits year over year. In June, F1 was released in theaters, "one of the summer's most unforgettable blockbusters." We celebrated a big anniversary with 10 years of

Apple Music. "We launched an all-new studio space in Los Angeles for artists to create content and connect with fans." Later this year, users get auto-mix and lyrics translation.

2:14 pm: The

App Store continues to be the "very best place to discover the latest apps from developers around the world in a safe and trusted way" and revenue grew double-digits year over year.

2:14 pm: Apple Online Store just launched in Saudi Arabia, and new stores are coming to the UAE and India later this year, with a new store opening in Osaka, Japan.

2:15 pm: "Across everything we do at Apple, we show up by leading with our values. We feel strongly that the benefits of technology should be shared by everyone. That's why we make technology for everyone. In May, to mark Global Accessibility Awareness Day, we announced... magnifier for Mac, a new Braille experience, and accessibility reader, a new system wide reading mode to make it easier to understand content."

2:16 pm: Apple is also working on recycling rare earth materials and investing in America and elsewhere, with $500 billion in investment in the US over the next four years.

2:17 pm: "The situation around tariffs is evolving, so let me provide some color there. For the June quarter, we incurred approximately $800 million of tariff related costs. For the September quarter, assuming the current global tariff rates, policies and applications do not change for the balance of the quarter and no new tariffs are added, we estimate the impact to add about $1.1 billion to our costs."

2:17 pm: CFO Kevan Parekh is on now, giving more information on the financials.

2:18 pm: "Our installed base of active devices grew to an all-time high across all product categories and geographic segments."

Services revenue was $27.4 billion, an all-time record. Company gross margin was up 46.5%, at the high end of the guidance range, down 60 basis points sequentially, primarily driven by $800 million in tariff-related costs. Product gross margin was 34.5%, Services gross margin was 75.6%.

2:19 pm: The iPhone active install base grew to an all-time high, and a June quarter record for upgraders. A recent survey showed the iPhone was the top-selling model in the US, urban China, the UK, Australia and Japan in the quarter. "We continue to see very high levels of customer satisfaction in the US, at 98%, as measured by 451 Research."

2:20 pm: Mac revenue was driven by continued strength across the portfolio, growing in every geographic segment, including double-digit growth in Europe, China and the rest of Asia Pacific. US satisfaction is 97%.

2:20 pm: iPad revenue was down 8%, an expected decline based on the difficult compare against the launch of

iPad Air and

iPad Pro in the year-ago quarter. Customer satisfaction is 98% in the US.

2:21 pm: Wearables, Home and Accessories revenue was down 9% year over year, given a different compare on accessories due to the prior year's iPad launches. Apple Watch reached a new all-time high with more than half of customers new to the product. Apple Watch satisfaction in the US is 97%.

2:22 pm: Services revenue was up 13%, with all-time revenue records on cloud services driven by year over year growth of iCloud-paying accounts. Growth of the installed base of active devices "gives us great opportunities for the future customer engagement across our services offerings."

2:23 pm: Apple ended the quarter with $133 billion in cash and marketable securities. $5.7 billion debt maturities, issuing $4.5 billion of new debt and $4 billion in commercial paper. $102 billion in total debt, with net cash of $31 billion after returning $27 billion to shareholders through $3.9 billion in dividends and $21 billion in open market repurchases of 104 million Apple shares.

2:24 pm: Assuming tariffs and global macroeconomic outlook does not worsen, Apple rexpects total company revenue to grow mid-to-high single digits year over year, Services to grow at a year-over-year rate similar to the June quarter. Gross margin between 46% and 47%, and operating expenses between $15.6 and $15.8 billion, and a tax rate around 17%. A cash dividend of $0.26 per share will be payable on August 14.

2:25 pm: The Q&A segment is now beginning.

2:28 pm: Q: On CapEx, it's up notably year-to-date, can you comment on capital spending plans this year and next, and what's driving that growth? Is it AI related or supply chain diversification?

A: It's a combination of factors. A significant factor is AI, we're investing in private cloud compute including our first-party data centers. We also have a hybrid strategy using third-parties to invest as well as our own. We also have investments and tooling, but a significant driver of growth is the AI-related investments.

Q: On upgrade rates, it's encouraging to see the records on iPhone, Mac and Watch — are you seeing strength in upgrade rates or is it the growing installed base? What made upgrades compelling this year? Tariffs? Apple Intelligence?

A: If you look at iPhone, the 16 family grew double-digits over the 15 family, so we set an upgrade record. I think it's directly a result on the strength of the product. Mac directly set upgrades and we continue to see a move to

Apple Silicon. The performance of Apple Silicon is playing a key role. If you're wondering about pull-forward, we would estimate the pull-forward of demand into April, specifically, to be about 1 point of the 10 points in terms of people buying over discussions about tariffs.

2:29 pm: Q: Shortly after March earnings, there were some reports on searches on Safari declining in April for the first time in two decades. It doesn't seem to indicate that any trends played out through the June quarter, can you give some color on how the quarter played out and if you believed Apple's products as search access points are losing strategic value as AI grows or losing strategic value?

A: I think they continue to be very valuable. Consumer behaviors are evolving and we're monitoring it very closely.

2:31 pm: Q: Can you elaborate a bit on what you're seeing in China? Some of the promotions are tailwinds, but how do you characterize some of the demand interest in the iPHone 16 and are the trends in the June quarter one-time or unique?

A: We did grow in Greater China by 4% during the quarter over the previous quarter, driven largely by an acceleration on iPhone, although we also had substantial growth on the Mac year over year. The government has certain subsidies that affect some of our products but not all of them, I think that had some effect. It was the first full quarter of the subsidy playing out. It cut in during a portion of the previous quarter.

The install base hit a record high in Greater China and we set an all-time record for the iPhone install base. iPhone upgraders set a record for the June quarter, and... iPhone had the top three models in Urban China which is extraordinary. Other products, Mac, iPad and Watch, the majority of customers of people buying in China mainland are new to the product. Lots of good things there. The other thing I would point out, MacBook Air was the top-selling laptop model in all of China, and Mac Mini was the top-selling desktop model in all of China. Overall, it's a very positive quarter.

2:32 pm: AAPL is up over $213 during after hours trading, with a strong move upward during the call.

2:34 pm: Q: Asking about Siri and the overall AI investment. How is your confidence towards that launching next year? Is there anything that's being done internally to increase that confidence?

A: We're making good progress towards a more-personalized Siri, and we're making good progress to launching that next year. Our focus is on putting AI features across the platform that are deeply personal, private and seamlessly integreated. We are significantly growing our investment, we did during the June quarter and we will again in the September quarter. I'm not putting specific numbers behind that at this point, but you can tell in the guidance that things are moving up. We are putting all of our energy behind it.

In terms of other products, I don't want to comment on specific other products, but we have an exciting roadmap ahead. I could not be more excited about it.

2:36 pm: Q: On the overall revenue guide, I appreciate that you guide the best you can see it. But why would it decelerate if services is staying the same, where's that conservatism? Currency should be just as favorable if not more favorable?

A: From Q3 to mid-to-high single digits, keep in mind two components. First, the effect of tariff pull-ahead in demand, and the September quarter of the year ago, we had the full-quarter impact of the new iPad launches versus this year. From Q3 to Q4, I would say foreign exchange is a minor tailwind so not a major factor.

2:37 pm: Q: You said similar growth in Services and that's predicated on Google Payments continuing, is there any way to dimensionalize or talk about options if the payments were not allowed in some way.

A: I don't really want to speculate on the court ruling and how they would rule and what we would do as a consequence of it.

2:38 pm: Q: At a high level, when you look at some of the perceived fears of new form factors and ways to interact with devices, there's some worry that there could be a world here dependence on screen based devices significantly diminishes. I'm curious your thoughts if you think that will happen and the rate and pace at how Apple is preparing for that?

A: When you think about all the things an iPhone can do, from connecting people to bringing app and game experiences to life, to taking photos and videos to helping users explore the world and conduct their financial lives and pay for things and so much more. You know, it's it's difficult to see a world where iPhone's not living in it. That doesn't mean we're not thinking about other things as well. Devices are likely to be complimentary, not substitution.

2:40 pm: Q: The tariff hit of $1.1 billion in the September quarter, can you talk about assuming tariffs remaining at these levels or evolving under Section 232, how do you offset this headwind into your P&L and when do you decide to execute on the levers to offset this headwind versus your bottom line?

A: We're just estimating the cost of it and it's up quarter over quarter, because our volume is up and there was some build-ahead in the previous quarter. That's the primary reason. In terms of mitigation, we try to optimize our supply chain and obviously we try to optimize our supply chain and ultimately we'll do more in the United States. We've committed $500 billion in the US over the next four years, and we've already started building chips in Arizona and semiconductors across 12 states and 24 factories and lots of other things in the works. We continue to explore these things and look for more that we can do, which ultimately is the objective.

2:42 pm: Q: On Services growth, 13% is extremely impressive. DO you see any impact from the Epic case and the steering dynamics?

A: Very strong services revenue, it was very broad-based and saw strength in emerging markets. We only just made the change required by the court in the June quarter, we don't provide a lot of detail but we just had double-digit growth on the US App Store and we'll continue to innovate and ensure that App Store delivers the best experience for users and remains a great business opportunity for developers.

2:46 pm: Q: On supply chain, you talked about focusing production and assembly to India, wanted to get an update on how you're thinking about that, and with India tariffs being higher than anyone expected. You mentioned US investments, but what about China versus the rest of Southeast Asia and India going forward? Also, where did demand on iPhone come from? This is stronger in June than normal, so what drove that? Promotions or something else?

A: In terms of tariffs and country of origin, one thing I would say is that the vast majority of our products are covered under the Section 232 investigation. Today, or last quarter, the bulk of the tariffs that we paid were the IEEPA tariffs that hit early in the year related to China. That's just a reminder of where things are and what we assumed as we calculated the projection of $1.1 billion that's in our outlook color. In terms of the country of origin, it's the same as I referenced last quarter, there hasn't been a change to that. The vast majority of the iPhones sold in the US, or the majority, have a country of origin of India. The vast majority of the other products, Mac and iPad and Watch have a country of origin of Vietnam that are sold in the US. Still, the products for other international countries, the vast majority of them are coming from China. That hopefully gives you a flavor of where things are. I would stress again that we do a lot in this country, in the United States, and we've committed $500 billion and we're always looking to do more. You could kind of see that in the most recent announcements, whether MP Materials or our manufacturing academy that we're standing up in Detroit. We're going to be doing more in this country, and that's on top of having roughly 19 billion chips coming out of the US now. We will do more. Glass for iPhone, the FaceID module, there's loads of different things done in the United States.

On iPhone, as Tim outlined, we think the strong upgrade performance was on the strength of the product lineup. The iPhone 16 family has done incredibly well. We recently introduced the 16e which continued to impact the success of the iPhone 16 lineup.

2:48 pm: Q: Was there any pull forward on channel inventory related to seasonal trends?

A: From the beginning of the quarter to the end of the quarter, we reduced it, and it ended towards the low end of our targeted range. We did see some obvious signs of pull ahead in April, that was about a 1 point impact of the 10 point total company level of growth. That was the limited impact that we believe we saw in the quarter.

2:49 pm: Q: Curious about your thoughts on AI for edge devices. Some people think that LLM could be a commodity in the future. Do you think a LLM could become a part of your iOS, and what's the evolution of edge devices and will the smartphone be the choice of device?

A: The way that we look at AI is that it's one of the most profound technologies of our lifetime, and I think it will affect all devices in a significant way, what pieces of the chain are commoditized and not commoditized? I wouldn't want to to really talk about today, because that gives away some things on our strategy.

2:50 pm: Q: Referring to the pull ahead being about 1 percentage point, do you have anything to share in what underlined that estimate? Was it on iPhone or across the board, primarily in the US or multiple regions, any color there would be helpful for how you get to that assumption.

A: It was principally on iPhone and Mac, and it was pretty obvious evidence of it. Unusual buying patterns there, largely occurred in April towards the beginning of the quarter. It was really, we believe, largely in the United States.

2:52 pm: Q: On tariffs, around $800 million (you estimated $900 million), you highlighted there were some unique factors in the quarter. Was there anything unique in September or December quarter that would uniquely affect those quarters as you highlight that from quarter to quarter there would be unique factors?

A: I would be careful about projecting based on the numbers from Q2 and Q3 because, one, we're uncertain of what the rates will be, so the rates may change. Two, in particularly last quarter, we had some build-ahead inventory that we had within the company and within our supply chain. Those two are a little unique. Also, as you know from following us for so long, Q1 is generally a higher-volume quarter. The tariffs are currently pretty linear with volume.

2:54 pm: Q: When we think about currency impact, how much of a benefit was currency this quarter and, across the business in Services, how much currency benefit should be embedded in the guidance in September? CapEx is clearly moving higher, and I know you're not guiding to that number, but qualitatively, as you lean in more on AI, should we see CapEx start to move appreciably higher?

A: For Q3, we really had no impact from foreign exchange on revenue growth and gross margin, there's virtually no impact from FX. From June to September, there's a very small tailwind from a FX standpoint on both revenue and gross margin. On your second question, on CapEx, we talked about how we are increasing our investments in AI, you'll continue to see our CapEx grow, you won't see exponential growth, and that's a function of investment in AI and other items that fall into that category, including facilities and retail. We also have a hybrid investment model where we have third parties invest, and we also invest in our own first party infrastructure.

2:56 pm: Q: You showed impressive updates on Vision Pro with Persona and other ways to create content. Other companies are seeing strong momentum on AI glasses. Are you still focusing on enterprise or broadening the use cases and tying it to more of your devices? Any thoughts on Vision Pro?

A: Thanks for bringing it up. I was thrilled with the release from the team on VisionOS 26. It includes many things like special widgets, personas, and new enterprise APIs for companies as well. We're seeing those things resonate out with CAE and other customers, so we continue to be very focused on it and I don't want to get into the roadmap on it, and this is an area we really believe in.

2:57 pm: Q: You haven't done big M&A historically, do you think you need to accelerate your AI road map or just keep the organic focus?

A: We've acquired around 7 companies, from all walks of life, not just AI. We're doing one every several weeks. We're very open to M&A that accelerates our roadmap. We are not stuck on a certain size company, although the ones we have acquired so far this year are small in nature. We basically ask ourselves whether a company can help us accelerate our roadmap. If they do, we're interested, but we don't have anything to share specifically to that.

2:57 pm: The call has concluded.

This article, "

Apple Reports 3Q 2025 Results: $23.4B Profit on $94B Revenue" first appeared on

MacRumors.comDiscuss this article in our forums

Apple BKC in Mumbai, India

Apple BKC in Mumbai, India