Apple today

announced financial results for the fourth fiscal quarter of 2025, which corresponds to the third calendar quarter of the year.

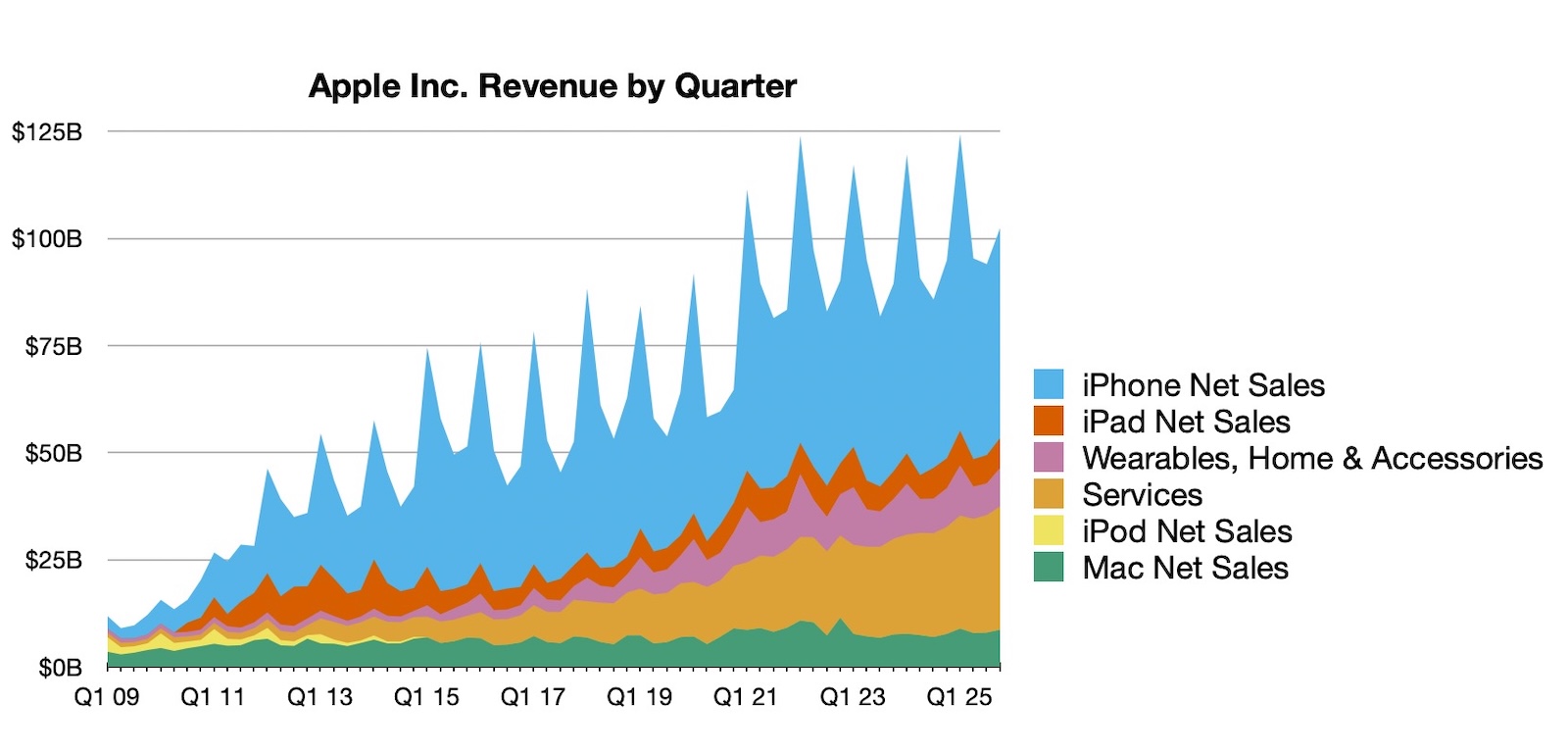

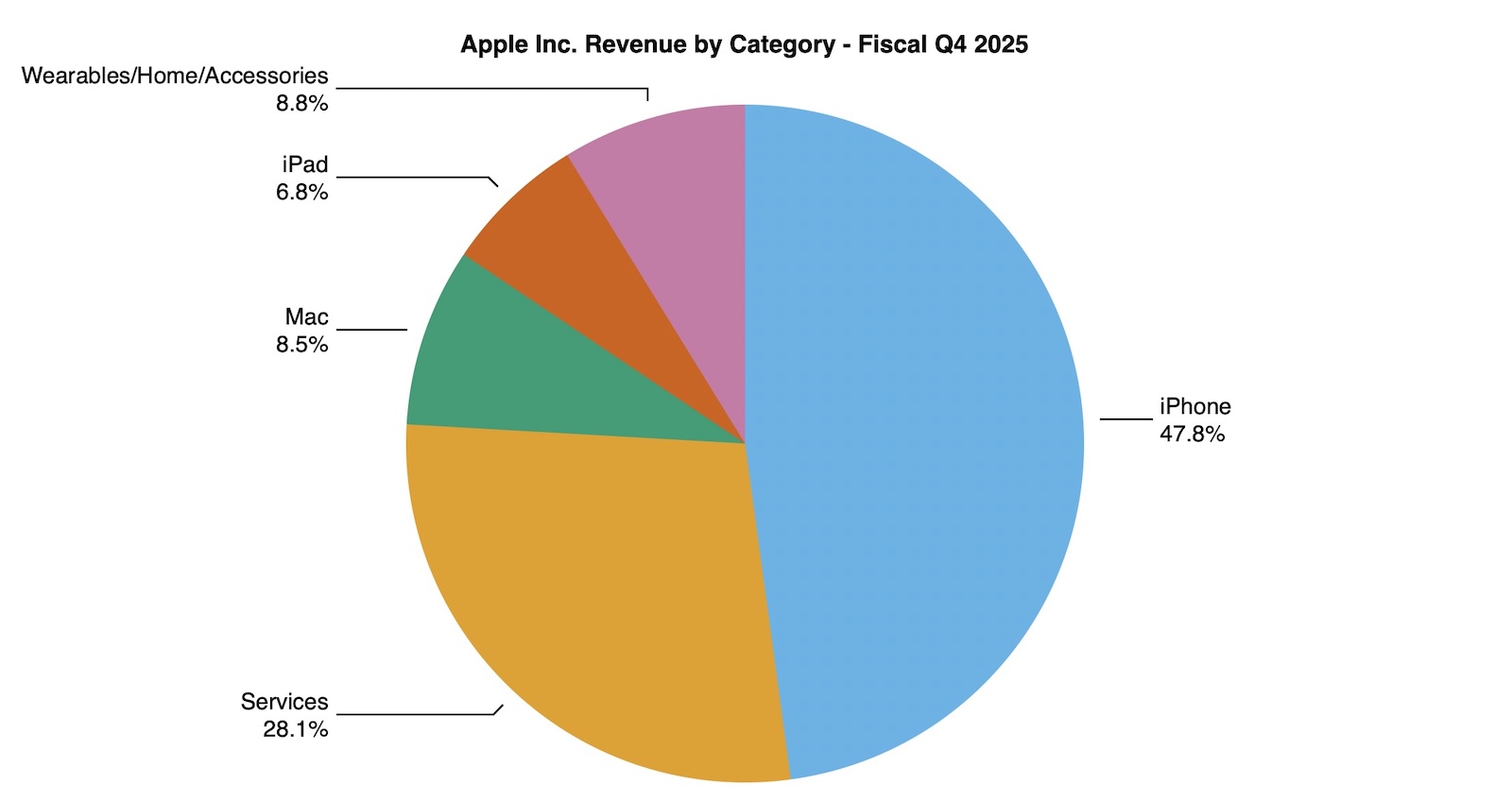

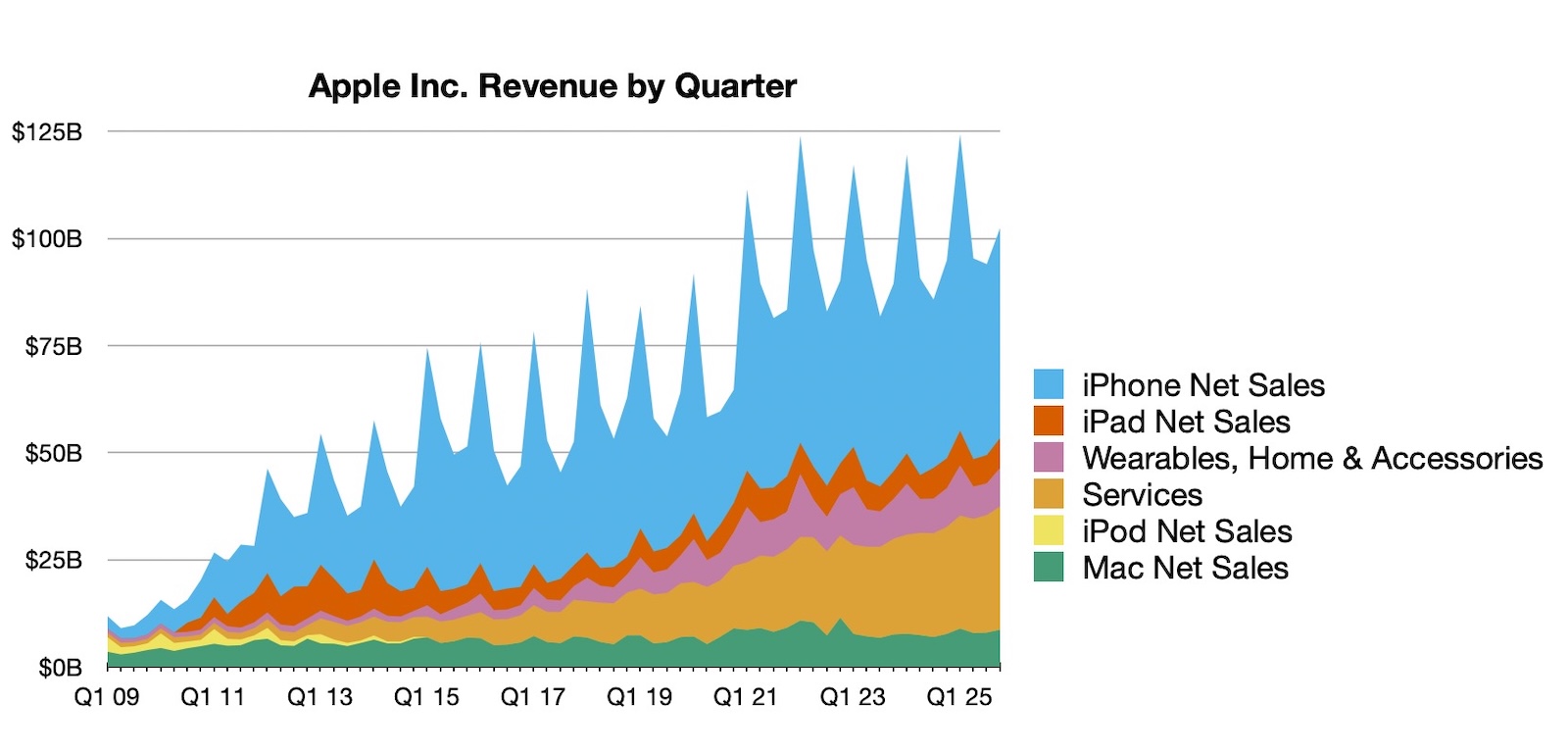

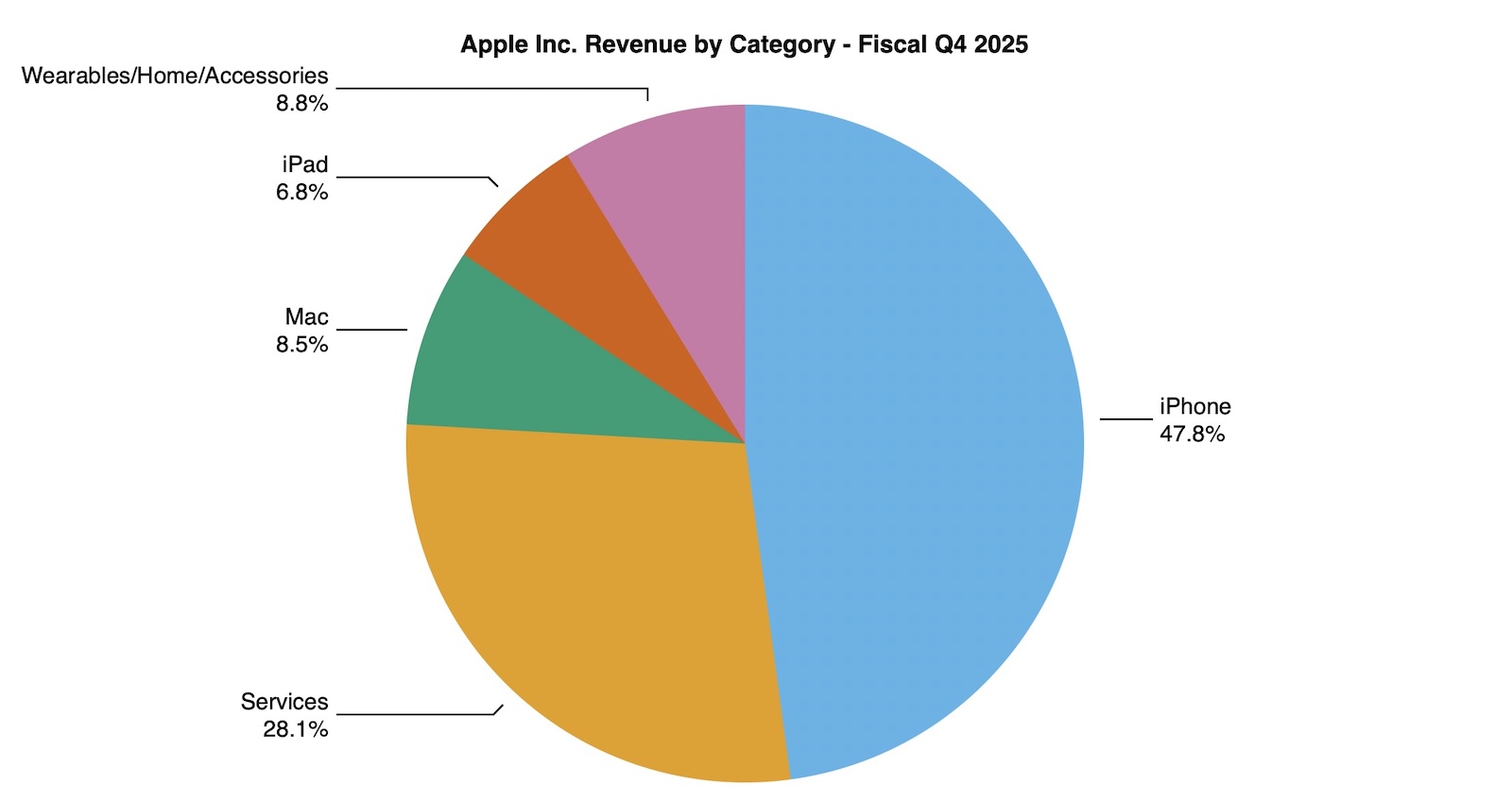

For the quarter, Apple posted revenue of $102.5 billion and net quarterly profit of $27.5 billion, or $1.85 per diluted share, compared to revenue of $94.9 billion and net quarterly profit of $14.7 billion, or $0.97 per diluted share, in the

year-ago quarter.

Apple's profits in the year-ago quarter were hit hard by a one-time charge of $10.2 billion over

tax issues in the European Union. Without that one-time charge, Apple's profits in the year-ago quarter would have been $1.64 per share.

Gross margin for the most recent quarter was 47.2 percent, compared to 46.2 percent in the year-ago quarter. Apple also declared a quarterly dividend payment of $0.26 per share, payable on November 13 to shareholders of record as of November 10.

Apple set September quarter records for total revenue,

iPhone revenue, and earnings per share, and an all-time record for Services revenue.

For the full fiscal year, Apple recorded $416.2 billion in sales and $112.0 billion in net income, compared to $391.0 billion in sales and $93.7 billion in net income for fiscal 2024. Both numbers set all-time fiscal year records for Apple, topping previous highs set in fiscal 2022.

"Today, Apple is very proud to report a September quarter revenue record of $102.5 billion, including a September quarter revenue record for iPhone and an all-time revenue record for Services," said Tim Cook, Apple's CEO. "In September, we were thrilled to launch our best iPhone lineup ever, including iPhone 17, iPhone 17 Pro and Pro Max, and iPhone Air. In addition, we launched the fantastic AirPods Pro 3 and the all-new Apple Watch lineup. When combined with the recently announced MacBook Pro and iPad Pro with the powerhouse M5 chip, we are excited to be sharing our most extraordinary lineup of products as we head into the holiday season."

As has been the case for over five years now, Apple is once again not issuing detailed guidance for the current quarter ending in December, though it should provide some color on things in its conference call.

Apple will

provide live streaming of its fiscal Q4 2025 financial results conference call at 2:00 pm Pacific, and

MacRumors will update this story with coverage of the conference call highlights.

Conference call recap ahead...

1:40 pm: Apple's share price is roughly flat in after-hours trading following the earnings release, after rising 0.6% in regular trading earlier today.

1:40 pm: "Our September quarter results capped off a record fiscal year, with revenue reaching $416 billion, as well as double-digit EPS growth," said Kevan Parekh, Apple's CFO. "And thanks to our very high levels of customer satisfaction and loyalty, our installed base of active devices also reached a new all-time high across all product categories and geographic segments."

1:44 pm: Quarterly iPhone revenue was up 6.1% year-over-year, while Mac revenue was up 12.7% and Services revenue was up 15.1%.

iPad revenue was essentially flat, while Wearables revenue was down 0.3%.

1:46 pm: Looking at revenue by geographic segment, the Americas were up 6.1%, Europe was up 15.2%, Japan was up 12.0%, and Rest of Asia Pacific was up 14.4%. The only weak segment was Greater China, which was down 3.6%.

1:47 pm: The quarterly earnings call between Apple CEO

Tim Cook, CFO Kevan Parekh, and analysts will begin at the top of the hour.

1:48 pm: Apple's share price has risen in the last few minutes and is now up 3.5% compared to the 4:00pm Eastern close.

1:52 pm: Regarding the current December quarter: "We expect total company revenue to grow by 10 to 12% year over year, we expect iPhone revenue to grow double digits, year over year, and we expect that that would make the December quarter the best ever in the history of the company," Cook

told CNBC.

2:01 pm: The call is beginning with the standard warnings on forward-looking statements, legal and regulatory proceedings, tariffs, and other developments.

2:03 pm: Tim is starting his introductory remarks, sounding upbeat about the results, including the September quarter revenue record, up 8% from last year, and an all-time Services revenue record of $28.8 billion, up 15% from last year. Earnings per share was $1.85, a September quarter record. September quarter records were set in dozens of markets in the US, Canada, Latin America, Western Europe, the Middle East, Japan, Korea and South Asia. September quarter records were set in emerging markets and an all-time revenue record for India.

2:04 pm: Apple set an all-time revenue record for the complete fiscal year of $416 billion.

2:04 pm: For the full year, Apple set records in iPhone and in Services, as well as across every geographic segment.

2:05 pm: He's now going through the various new products launched recently, hyping up the company's upcoming December holiday quarter.

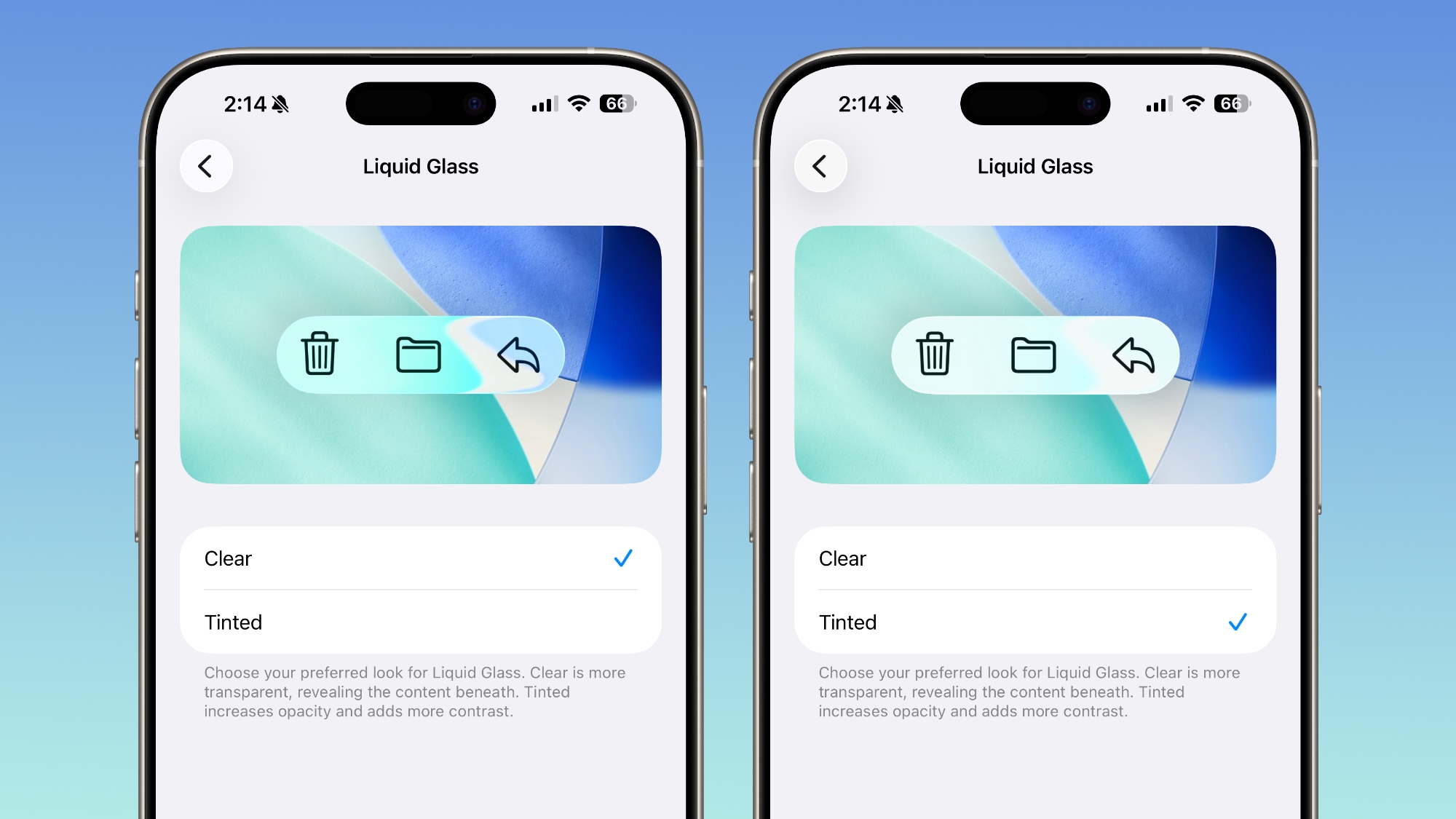

2:07 pm: Apple is selling new iPhones, M5

iPad Pro, M5

MacBook Pro, M5

Apple Vision Pro, as well as the new Liquid Glass user interface on nearly all Apple's platforms.

2:07 pm: There are new AI features including Live Translation and Workout Buddy, too.

2:07 pm: He says Apple is making "good progress" on the more personalized

Siri, and it's expected next year.

2:08 pm: iPhone faced supply constraint on

iPhone 16 and

iPhone 17 models during the quarter, and set a revenue record for the September quarter at $49 billion, up 6% from last year, with growth in the majority of tracked markets.

2:09 pm: Mac revenue was $8.7 billion, up 13% year over year, driven by the strength of the

MacBook Air.

2:09 pm: iPad revenue was $7 billion, with

iPadOS 26 launching as well as the new M5 iPad Pro.

2:10 pm: "The new iPad Pro makes every interaction delightful with its thin, light and portable design."

2:10 pm: Wearables, Home and Accessories revenue was $9 billion, with the new Apple Watch lineup.

2:11 pm: "AI and advanced machine learning are at the core of powerful health features like heart rate monitoring, fall detection, crash detection and more."

2:12 pm: There are new features including hypertension detection and sleep score, as well.

AirPods Pro 3 "have been a huge hit" with users and reviewers alike praising the sound quality and improved fit.

2:12 pm: For Services, revenue was $28.8 billion for the quarter, an all-time record. Double-digit growth in both developed and emerging markets, and all-time records in Advertising,

App Store, Cloud Services, Music, Payment Services and Video.

Apple TV won 22 Emmy Awards.

2:13 pm: Apple TV will pick up Formula One in the US next year. "F1 is one of the most exciting and fastest growing sports in the world. Starting next year, Apple TV will be the place for subscribers to follow every twist and turn of the new season."

2:14 pm: The quarter marked the 10-year anniversary of

Apple News.

2:14 pm: Retail has seen the first stores in India and the UAE, plus new stores in the US and China. Apple Ginza, the company's first overseas store, was just redesigned and reimagined.

2:16 pm: Apple is committed to invest over $600 billion in the United States, supporting more than 450,000 jobs across thousands of suppliers in all 50 states. A new factory in Houston started shipping products for advanced AI services.

2:17 pm: Now Kevan is on to discuss things in more detail.

2:17 pm: Growth was driven by sales of iPhone and Mac, with installed, active devices reaching an all time high across all product categories and geographies. Services revenue was up double digits in the majority of markets.

2:18 pm: Gross margin was 47.2%, above the high end of the guidance range, up 70 basis points sequentially, driven by favorable mix. It includes $1.1 billion of tariff-related costs. Hardware gross margin was 36.2%, up 170 basis points, driven by favorable mix. Services margin was 75.3%, down 30 basis points sequentially. OpEx was $15.9 billion, up 11% year over year, driven by increased investment in R&D.

2:19 pm: Earnings per share was $1.85%, up 13% year over year on an adjusted basis.

2:19 pm: Cash flow was a September quarter record at $29.7 billion. iPhone set a September quarter record for upgraders, and iPhone was the top-selling model in the US, urban China, the UK, France, Australia and Japan. Customer satisfaction in the US was 98%.

2:20 pm: Mac revenue was $8.7 billion, with double-digit growth in emerging markets and strong growth in every geographic segment. 96% customer satisfaction, and the install base reached another all-time high.

2:20 pm: iPad was $7 billion, flat year-over-year, against a difficult compare against last year's

iPad Air and iPad Pro launch. New all-time high for the install base, and half of cutsomers who purchased an iPad were new to the product. 98% customer satisfaction in the US.

2:21 pm: Wearables, Home and Accessories revenue was $9 billion, flat, but driven by growth in Watch and AirPods, offset by accessories which were affected by the iPad launches last year.

2:22 pm: Services set revenue records in the Americas, Europe, Japan, Rest of Asia Pacific, and a September quarter record in Greater China. All-time revenue records in payment services and saw double-digit growth year over year on

Apple Pay active users. Revenue in Services passed $100 billion for the year, up 14%. Both transacting and paid accounts reached new all-time highs.

2:23 pm: Apple is also continuing its penetration in the enterprise. BMW is deploying thousands of iPhones, including to factory employees, and Capital One is expanding its Mac Choice program to add thousands of MacBook Airs across its workforce.

2:24 pm: Apple has $132 billion in cash and marketable securities. $1.3 billion of debt maturities, decreased commercial paper by $1.9 billion, with $99 billion in total debt. Net cash of $34 billion. Returned $24 billion to shareholders, with $3.9 billion in dividends and equivalents and $20 billion through repurchases of 89 million Apple shares.

2:24 pm: $416 billion in yearly revenue, with growth on iPhone, Mac, iPad and Services. Full year operating results with all-time records of net income and diluted EPS, which grew double-digits year over year on an adjusted basis.

2:25 pm: We expect December quarter company revenue to grow by 10-12 percent year over year. iPhone revenue to grow double-digits year over year. On Mac, we expect a difficult compare against last year. Services to grow in a year over year rate similar to fiscal 2025. Gross margin between 47 and 48%, and estimated $1.4 billion in tariff related costs. We are significantly increasing our investments in AI, with operating expenses between $18.1 and $18.5 billion.

2:26 pm: Cash dividend of $0.26/share, payable on November 13, 2025.

2:26 pm: Now we're moving to the Q&A portion of the call.

2:27 pm: Q: Why do you think the iPhone 17 is having the degree of success it is as this point? Is this the age of the install base replacement cycle, specific features or functionality this cycle?

A: I think it's all about the product. The lineup is incredibly strong, our strongest ever. The Pro is the most pro phone we've ever done, the design sings, the

iPhone Air feels so thin and light in your hand it feels like it's going to fly away. And then the 17 phone is an incredible value and brings several features that were reserved for Pro and brings them down to the consumer lineup. Strongest iPhone lineup ever and it's resonating around the world.

2:29 pm: Q: Can you discuss your approach to managing component cost inflation? Memory prices are going through some pretty significant inflation.

A: We have a world class procurement team and they're finding ways to drive cost opportunities. We're seeing changes in memory and storage prices, but as seen in our gross margin performance, I think we're managing costs pretty well. We just launched a bunch of new products and they do have a higher cost structure, but we focus on getting those costs down over time.

2:30 pm: Q: Can you talk about iPhone in China? How is that trend going into December and have you turned the corner there?

A: I was just there, store traffic is up significantly, it's incredibly vibrant and dynamic. The iPhone 17 family has been very well received there. We believe that we'll return to growth in Q1, largely based on the reception of the iPhone there. I couldn't be more pleased with how things are going there in the early going.

2:31 pm: Q: Wondering if the antitrust ruling, if there was anything in the Google trial that affected your performance in Services.

A: There was no tax related impact, our strong performance in the quarter was really organically driven. Nothing abnormal at all, pretty much all organic growth.

2:33 pm: Q: Services revenue growth was the fastest across many categories and fastest in the last two years, if you could unpack the drivers of the acceleration — was there cross selling with the new iPhone launch, install base growth, you've been doing a lot of bundling with

Apple One and

AppleCare One, any thoughts on that would be very helpful.

A: The way we looked at it, it's not one thing to point to. It's higher than we've seen the last few quarters but the Services profile is very broad with lots of different businesses. Our strength was very broad across categories and geographically, so wouldn't point to one factor that drove any kind of performance.

2:34 pm: Q: On iPhone sell-through, are you seeing any notable shifts in trends between sell-through coming from upgraders versus switchers, US carrier dynamics, promotional activity and channel inventory?

A: We set a September quarter record for upgraders so it was a great quarter from that point of view, it's too early in the cycle on 17 to make any comments about upgraders or switchers. In terms of channel inventory we ended the quarter toward the lower end of the targeted range. We are constrained today on several models of iPhone 17 today, there's not a ramp issue we just have very strong demand. We are working hard to fill all the orders that we have.

2:35 pm: Q: Can you walk through the expectations on gross margin in December quarter, I think it implies up 30 basis points, can you talk through the puts and takes on there?

A: Targeting 47-48 percent, a lot of puts and takes. This is a quarter we launched a lot of new products that are more expensive than those we replace, those were more favorable mix and higher leverage, those are the two big drivers but really favorable mix from the product side.

2:37 pm: Q: For China, what resulted in the weakness over there and the pause, what drove the weakness in September? What is the uptick for December?

A: Greater China revenue was down 4% year over year, driven by iPhone and if you look at the iPhone, the majority of the sequential year over year change was due to supply constraints mentioned earlier. That drove the results. We're thrilled with what we're seeing now with traffic up and the reception of the 17 family. We expect a return to growth this quarter.

2:38 pm: Q: Regarding constraints and demand for iPhones, do you see yourself exiting December without constraints or do you think they'll still be there at the end of the quarter? Do you know what revenue might have been without constraints?

A: If you look at the supply constraints, we are constrained on several 17 models. We're not predicting when the supply/demand will balance. We're obviously working very hard to achieve that, we want to get as many of these products out to people as possible. Today I'm not going to predict.

2:39 pm: Q: Talked about new records across a lot of categories and services. I didn't hear search explicitly called out. There are some concerns about search volumes decelerating at the expense of AI, how do you see these growth rates continuing for services?

A: Advertising, which is a combination of third-party and first-party, did set a record during the quarter.

Q: Both Apple's internal advertising and external set record?

A: I'm not saying that, we don't split that out. I'm dodging the question intentionally.

2:41 pm: Q: Strong momentum in China, what are your thoughts on subsidies in that region and how they play a role?

A: The subsidies play a favorable role, they're across multiple categories from PCs to tablets, smartwatches and smartphones, but it only applies to certain price ranges, there's a maximum price. Several of our products are above that price are not eligible for a subsidy. It does have a favorable effect and is driving some consumer demand.

2:42 pm: Q: On OpEx increase into December, that's a sizable step up. What are the components and that increase in OpEx exceeds your revenue growth, should we expect this to continue?

A: As we've been outlining, we are increasing our investments in AI, while also continuing to invest in our product roadmap. Vast majority of the increase is R&D, we're managing the company in a thoughtful and disciplined way an we're managing the business for the long term. We have seen OpEx growing faster than revenue, but we've seen gross margin expansion and operating income growth has been outpacing revenue growth for the past several years.

2:43 pm: Q: Can you help us understand the tariff impact sequentially from September to December, especially around iPhone supply constraints, tariffs going from $1.1 billion to $1.4 billion, but the uplift on iPhone revenue and production will be dramatically bigger so how do these tariff headwinds work as we move forward?

A: Yes, $1.1 to projection of $1.4, that's based on what we know right now and where the tariff rates and policies are. It assumes a stable environment for the quarter. It does comprehend the changes that were just made that we were very encouraged to see with the tariffs moving from 20% to 10% in China. That is factored in and is one of the reasons why it's not linear to volume.

2:45 pm: Q: When you think about it, you're going into a holiday season, the attach possibilties for other products to the iPhone in this season, is there an opportunity to see upside to iPhone attach?

A: We always like to remind people who buy an iPhone of all the other things that we offer. We're definitely doing that. From a Mac point of view, the challenge was the last year was the mother of all Mac launches. All of these, from

Mac mini to

iMac to all the MacBook Pros all launched literally at the same time. That compares to launching the 14-inch MacBook Pro, so it's a very difficult compare. In the long run, I'm very bullish on the Mac. You can see that the Mac again last quarter outgrew the market. We feel really well about how Mac is positioned but this certain quarter is an extremely difficult compare. We also had the DRAM upgrade last year for the Mac lineup, another factor.

2:47 pm: Q: On the iPhone constraints, is there a way to quantify how much business was left on the table because of the constraints, and does different iPhone manufacturing from different regions contribute to the constraints?

A: It was not related to manufacturing capacity per se. We called the number of iPhone 16 that we were going to make and we were a bit short of the demand, we're a bit short of where demand really was. We're not publicly estimating the extent of that. On iPhone 17, the demand is very strong and we came out of Q4 with lots of backorders.

2:48 pm: Q: Given the prevalence of chatbots and AI-infused web services, do you think that could change consumer behavior on the mobile app ecosystem or are you seeing any of that? Would there be any impact on the App Store?

A: I think there are opportunities on the App Store with artificial intelligence. We have made our on-device models available for developers and we've seen developers begin to adopt them. As that proliferates, there's an opportunity for developers and Apple to benefit from that.

2:49 pm: Q: When we look at the iPhone 17 demand, has there been any discernable changes in mix relative to prior cycles?

A: It's too early to call to the mix to be honest, and we don't publicly disclose that for competitive reasons, but we don't know what the mix will be because we have constraints at both the top and at the entry, we'll see what happens as we get more supply.

2:50 pm: Q: As we work through the AI narrative, can you provide thoughts on the build out of AI's private compute cloud?

A: Our PCC is being used today for a number of queries for Siri, and we will continue to build it out. The manufacturing plant that makes the servers used for

Apple Intelligence just started manufacturing in Houston a few weeks ago and we've got a ramp planned there for use in our data centers. It's robust. In 2025 we did have CapEx costs associated with PCC environment in our first party data centers, so some of that would be in our CapEx invest this year.

2:51 pm: Q: Does the consumer reception on iPhone Air give you a feel on the foldable phone market or are the two form factors too different?

A: I'm not sure that one is a proxy for the other. The thing that I would say, we don't get into the model demand, at the aggregate level we're thrilled with how iPhone has been received and that's why we're expecting double-digit growth in the coming quarter.

2:52 pm: Q: On personalized Siri, would you continue to use the three-prong approach with your own foundation models, partner with LLM providers or potential M&A?

A: We're continuing Apple foundation models, we ship them on device and use them in the Private Cloud Compute as well. We have several in development. We also continually surveil the market on M&A and are open to pursuing M&A if we think it will advance our roadmap.

2:53 pm: Q: We've often seen Apple be a fast follower, whether with large displays or 4G/5G, are you seeing AI capabilities being a material purchase consideration for consumers or are your record sales levels reflecting other factors?

A: There are many factors that influence people's purchasing considerations. We don't have a great, in-depth survey yet on the current iPhone 17 yet. It's very new in the cycle and we give it some time to formulate. I would say that Apple Intelligence is a factor. We're very bullish on it becoming a greater factor. That's the way that we look at it.

2:54 pm: Q: In the wake of every other tech company raising their CapEx in advance of AI demand, and mentioning scarce capacity, do you anticipate changing your hybrid approach to your own and third-party data centers and the role for Apple silicon?

A: We are expecting increases to CapEx spending related to AI spending... we had investments this year to build out our Private Cloud Compute environment. I don't see us moving away from this hybrid model with first-party and third-party capacity.

2:55 pm: And with that, the call — and Apple's 2025 fiscal year — are complete!

This article, "

Apple Reports 4Q 2025 Results: $27.5B Profit on $102.5B Revenue" first appeared on

MacRumors.comDiscuss this article in our forums

Note: MacRumors is an affiliate partner with some of these vendors. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.

Note: MacRumors is an affiliate partner with some of these vendors. When you click a link and make a purchase, we may receive a small payment, which helps us keep the site running.