Report: One in Four Smartphones Are Now iPhones

The findings from Counterpoint's Smartphone Installed Base Tracker show that the global installed base of active smartphones grew 2% in 2025, driven primarily by lengthening replacement cycles and the continued circulation of second-life devices. Unlike shipment figures, which measure yearly sales, installed base data reflects the total number of devices currently in use, making it a key indicator of long-term platform choices.

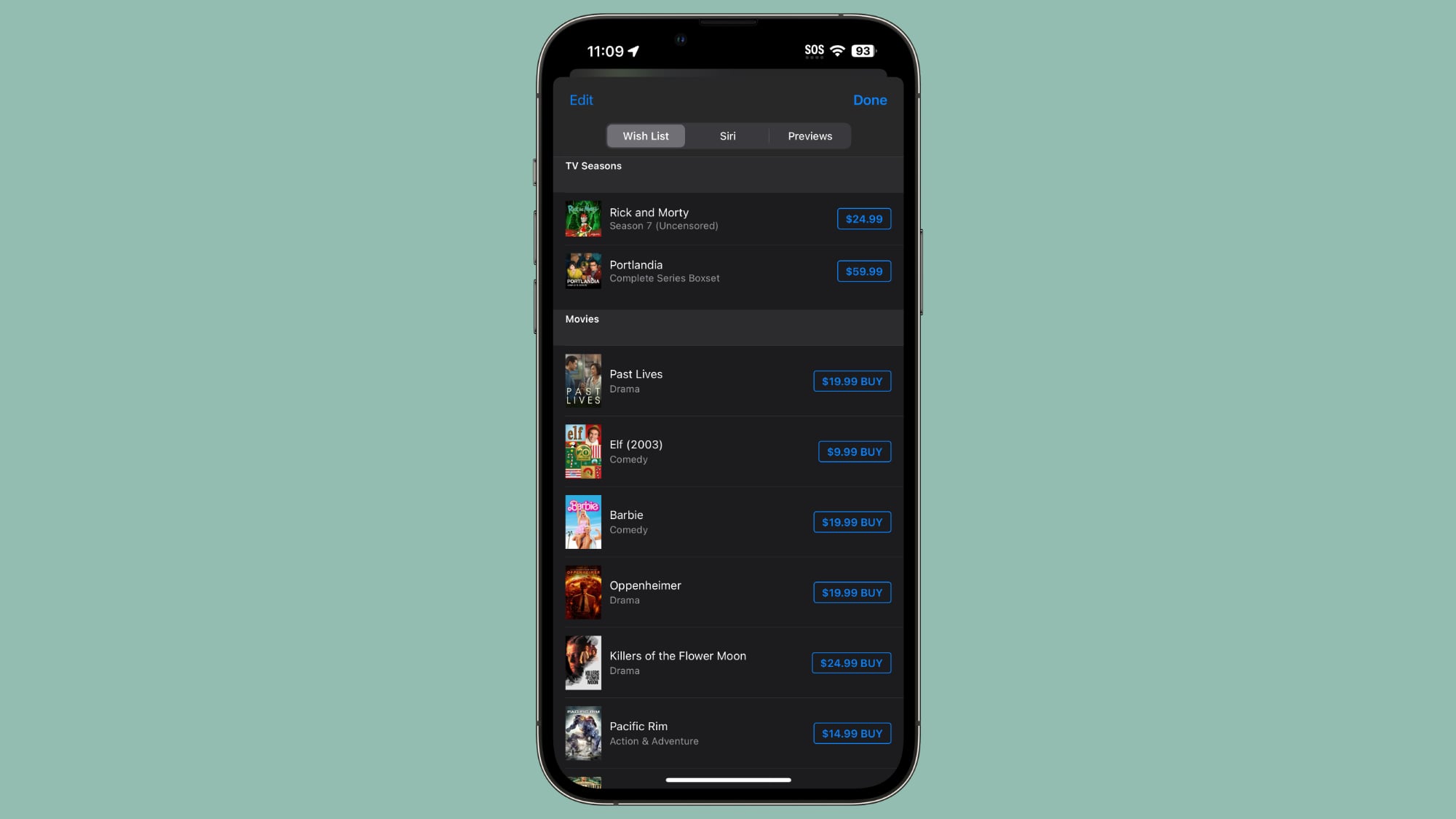

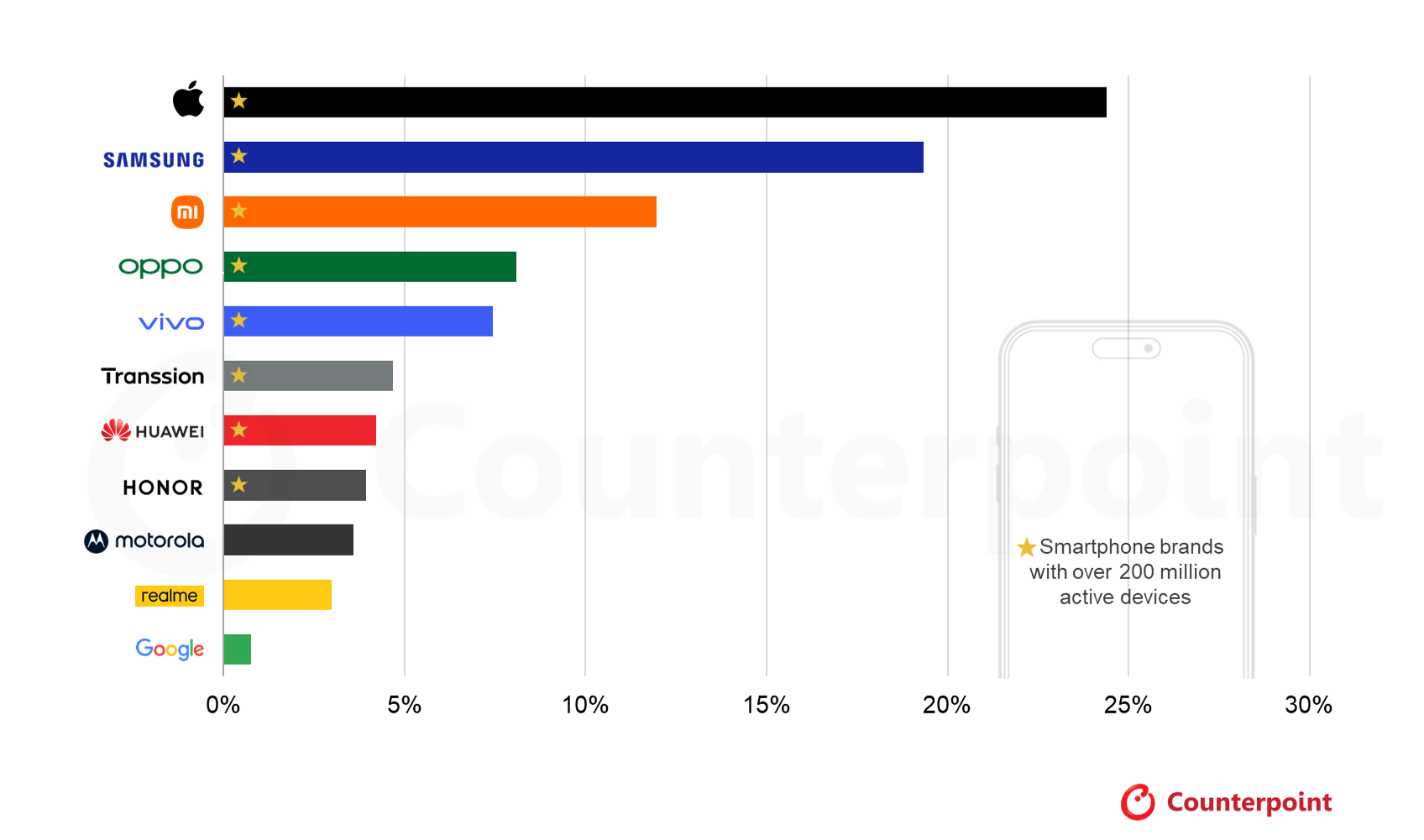

Apple now leads the global active smartphone installed base with roughly one in four devices in use being an iPhone. The firm attributes this position to a combination of strong user loyalty, integrated services, and the broader Apple ecosystem.

The report also claims that Apple added more net new active smartphone devices in 2025 than the next seven leading smartphone manufacturers combined, reflecting the company's ability to attract and retain users even as global smartphone growth slows and hardware innovation becomes more incremental.

Samsung ranked second with approximately one-fifth of the global active smartphone installed base. Together, Apple and Samsung accounted for 44% of the global installed base in 2025.

The gap between Apple and Samsung as the two market leaders and the rest of the industry is widening. The two companies are the only smartphone manufacturers to surpass one billion active devices globally.

Other brands, including Xiaomi, OPPO, and vivo, form a second tier with large but smaller installed bases built largely through midrange and upper-midrange devices. Notably, Transsion Group has grown its installed base through affordable devices targeted at price-sensitive markets in regions such as the Middle East, Africa, and Southeast Asia. HONOR is the most recent brand to surpass 200 million active devices, while Motorola and realme are approaching that milestone.

Apple's vast base of installed devices is attributed to a number of additional trends that favor premium smartphones. For example, device replacement cycles have extended to nearly four years as hardware improvements become more incremental and device durability improves. Premium devices typically receive longer software support, maintain higher resale value, and remain in active use longer, often through to second owners. Repeat purchases are also likely.

The report added that differentiation is increasingly shifting toward software and ecosystem integration as hardware innovation slows. Features such as on-device artificial intelligence, camera software, productivity tools, and cross-device integration are said to be key value drivers that help build long-term loyalty and increase usage. See Counterpoint Research's full report for more information.

This article, "Report: One in Four Smartphones Are Now iPhones" first appeared on MacRumors.com

Discuss this article in our forums